Would you buy an investment that was absolutely guaranteed to lose money?

Commentary: Millions hold an investment guaranteed to lose money

Would you buy an investment that was absolutely guaranteed to lose money?

More fromMarketWatch.com:

• Get Ready for Another Flash Crash

• Speculators Seen Leading Commodities Crash

• Credit Will Save Stock Bulls in Next 'Flash Crash'

No ifs, ands or buts: This sucker will make you poorer! How's that sound?

You might think this is a crazy question. You're probably thinking, who would choose to own an investment that is guaranteed to lose money?

The answer is lots of people. Millions. And most of them have no idea what's happening.

You may be among them.

You wouldn't believe what's going on in the bond market right now. If I hadn't seen it with my own eyes, I wouldn't either.

I'm talking about short-term Treasury Inflation-Protected Securities, known as TIPS. These are U.S. government bonds that are increasingly popular with investors. They offer a guaranteed rate of return on top of the official inflation rate.

A TIPS bond that has a "real" yield of say, 2%, will guarantee you the Consumer Price Index plus 2% over the life of the bond. If the CPI works out at 3% a year, you'll get 5%. If the CPI is 10%, you'll get 12% and so on.

Most of the time, TIPS have been a pretty good investment, especially for retirees and for conservative investors. They've earned you 2% to 3% a year above inflation, with no worry or fuss.

Right now?

These yields have collapsed. TIPS bonds are booming in price, and bonds work like a seesaw: When the price goes up, the yield goes down.

Ten-year TIPS are offering real yields below 1%. It's pitiful. The short-term TIPS are even worse.

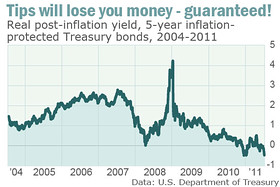

As you can see from our chart, the "real" or after-inflation yield on 5-year TIPS bonds has plunged into the red. It's minus almost half a percentage point a year. That's right: negative.

In other words, under almost any possible scenario, these bonds are guaranteed to lose you nearly half a percent of your purchasing power, each year, for the next five years — a total loss of 2.5%, guaranteed.

It's crazy. Totally nuts.

Some investment losses are unavoidable, but not this one. This one is a lock. Just take some money from your pocket and throw it away. In football terms, this isn't playing defense. This is taking a safety. Give up points.

Tom Atteberry, manager of the FPA New Income (FPNIX - News) bond fund, thinks it's absurd. "I struggle with why someone would accept a negative real return on their money," he told me. "If you look at history, owning a 5-year Treasury, my real return should be somewhere in the 2% to 2.5% range."

The real story on TIPS may be even worse. "That real yield is based on a manipulated statistic, the CPI," according to Josh Strauss, co-manager of the Appleseed Fund (APPLX - News). For most people, day-to-day costs are rising faster than the official Consumer Price Index.

The CPI today is just 2.7%. But costs for food are rising much faster. Milk is up 7% in a year, beef 14%, citrus fruits 8.5%. (Sure, iPads are getting cheaper, but how many can you eat?) Airline tickets are up 14%, hospital services 5.5%, gasoline 28%.

The only possible scenario in which any of these short-term TIPS bonds can avoid a loss is if we get persistent price deflation — in other words, widespread price falls. There are technical reasons why a small number of TIPS bonds might do OK. But the chances are extremely remote. Look around you. Do you see prices falling?

You can still get a positive "real" yield if you buy long-term TIPS bonds. The 20-year TIPS yield 1.4% over the CPI, the 30-year 1.7%. But even these are meager returns by historical measures.

Of course, these low yields are great news for Uncle Sam. He's borrowing your money really cheaply; your loss is his gain. But this is one tax that nobody is screaming about — maybe because they haven't noticed.

Some of the factors driving down TIPS yields are well known. The Federal Reserve has been driving down the yields on all bonds, including TIPS bonds, through the repurchase program known as Quantitative Easing II. Low growth expectations also have brought down yields. Investors worried about inflation have piled into TIPS bonds.

But why are people buying short-term TIPS bonds that will actually lose them money?

I suspect you can blame the usual Wall Street culprits, like investor ignorance, unscrupulous brokers and, of course, the "dumb money" fund industry.

Most fund managers are forbidden to hold cash. They also have to stick to their "mandates," no matter what. Bond managers have to buy bonds, and TIPS managers, TIPS. They are told to stick close to standard industry benchmarks. Even if they guarantee a loss

Chances are, these people are managing your money. You couldn't make it up.

*Brett Arends is a senior columnist for MarketWatch and a personal-finance columnist for *

Enjoyed this? Get more like it.

Glen's Musings — AI, investing, and building things. Occasional. Free.

Related Posts

- Andy Xie - I can't say it better than him $FXI $$

- Altucher - on losing millions, and $SLV

- $BAC $JPM $C $$ Banks that I'd give junk bond credit ratings

- $PSEC $LEE --- $T $CTL $FTR $NTLS $USMO $VZ $WIN $AEE $DUK $EXC $FE $TEG $POM $PPL

- $SLZM - Oil $3.44/gallon from Algae? That would solve so many problems.

Keep Exploring

Glen's Track Record

Full performance history from 2008 to present.

Read moreCurrent Positions

What Glen actually owns — every ticker, every share class.

Read moreFanniegate: The Full Story

The largest fraud in American capital markets history.

Read more157 Billionaire Profiles

What the world's most successful people got right.

Read moreDisclaimer: This blog post reflects the author's personal opinions at the time of writing and is not financial, investment, or legal advice. Glen Bradford holds positions in securities discussed on this site. Past performance is not indicative of future results. Do your own research and consult qualified professionals before making investment decisions. Some content on this site was generated or edited with AI assistance.