AT&T Dumps Yellow Pages Business: What This Means For Yellow Pages In Canada

AT&T (T) dumped their Yellow Pages business a few days ago. They sold a 53% stake to the private equity firm Cerberus Capital for $950M, effectively valuing the company as a whole at $1,792M. Given that their EBITDA for 2011 was $1,029M, the EBITDA multiple associated with this deal is 1.74x. Yellow Media Inc (YLWPF.PK) – the company that runs the Yellow Pages business in Canada – achieved an EBITDA of $680M for 2011. Their stock has been pummeled from over $6 to 7 cents in the course of 14 months as there is a perceived threat that the bondholders and banks, who are owed a little over $1.5 billion net of cash, will overtake the entire equity portion of the business, leaving current shareholders with next to nothing. If we consider the 1.74x multiplier for the AT&T Yellow Pages business as a barometer, the threat seems real as that would value Yellow Media at $1,190M, well less than their debt obligations.

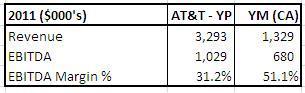

However, when looking at this deal we have to consider several factors, the number one factor being that as a monopoly in Canada, the Yellow Media business has superior cash flow prospects to any of the counterparts south of the border. Review the chart below.

AT&T’s Yellow Pages business attained $1,029M of EBITDA on $3,293M of revenues for a 31.2% EBITDA margin in 2011. The Yellow Media business attained $680M of EBITDA on $1,329M in revenue for a 51.1% margin in 2011. Further evidence of Yellow Media’s superior ability to extract revenues from the Canadian economy is considering that they attained $1,329M in revenue from a population of about 33.5M or $40 revenue per capita. Meanwhile the AT&T Yellow Pages business covers a population of 150M people for $22 revenue per capita, barely over half of Yellow Media’s per capita revenue. There is something structural about the Canadian economy that would suggest a print directory business does much better there than its US counterparts. The ability of the Canadian Yellow Pages business to extract monopoly revenues from the print business and associated economies of scale with holding a monopoly in a country where print still has a dominant role to play in its economy suggests Yellow Media deserves a significant premium over the AT&T deal.

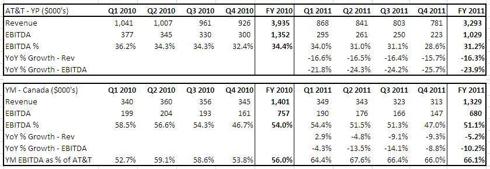

Reviewing the last 8 quarters of each company tells us even more.

AT&T’s print directory business is getting absolutely hammered. As bad as the revenue drop of 16.3% from 2010 to 2011 is, it is made even worse by the 23.9% decline in EBITDA which has steadily been picking up pace, topping out at a 25.7% decline in Q4. Contrast that to Yellow Media. While revenue has shrunk over 9% in each of the past two quarters, they turned around EBITDA in Q4 and actually slightly improved their margin from 46.7% to 47.0%.

Cerberus Capital didn’t pay 1.74x multiple of EBITDA for a company that is flat lining, they paid that amount for an entity that saw its EBITDA drop over 25% for the latest available data point in Q4 2011. At this pace, Yellow Media’s EBITDA will catch up to YP Holding’s EBITDA in two to three years. As seen in the last row of the chart, Yellow Media’s EBITDA as a percent of YP Holding’s EBITDA rose from a little over half to two-thirds from 2010 to 2011.

If we were to base the deal on forward looking EBITDA instead of 2011 EBITDA and if we were to estimate 2012 EBITDA based on 2011’s decline rate, YP Holdings’ EBITDA would be due for another 23.9% decline, or $783M. A $1,792M valuation would imply a 2.29x multiple. Declining Yellow Media’s EBITDA by another 10.2% in 2012 would land it at $610M. A 2.29x multiple implies a valuation of $1,397M.

Another thing to consider is that the AT&T Yellow Pages business benefits from having been carved out from a greater corporation. The Yellow Media business is valued as a full corporation and is very limited in what it can hide with respect to operating performance. It was well-known that AT&T was looking to sell their Advertising Solutions wing as 2011 wrapped up so the likelihood that window dressing took place as far as their auditors would allow cannot be overlooked. If there’s a customer being billed for other AT&T services in addition to a Yellow Pages listing and they received a bundling discount or some other type of incentive, would the other divisions pick up a disproportionate part of the contra revenue associated with the discount?

Of greater concern would be on the cost side. With a dinosaur corporation like AT&T there is a very good chance that divisions performed work for multiple revenue-generating units, particularly those providing support work to client-facing divisions like Finance and HR. Are those supporting business units costs fairly distributed within the Yellow Pages business when calculating their EBITDA?

Total revenue for the business was $3,293M and operating expenses were $2,264M in 2011. If revenue was overstated by just 1% and costs are understated by 2%, this leads to a $33M overstatement in revenue and $45M understatement of costs for a total EBITDA overstatement of $78M. Of course this is just speculation on my part and the true window dressing figure could be greater or lower than my back of the envelope calculation – or possibly none at all – but Cerberus Capital is not stupid. They would know that some level of window dressing potentially took place and that their bid would have to reflect that. If my $78M is anywhere near to their guess, the $1,792M valuation of the newly-formed YP Holdings LLC would be based off a 2011 EBITDA estimate of $951M, not the actual amount of $1,029M, for a multiple of 1.88x.

Considering that Yellow Media owns a Yellow Pages business that has a virtual monopoly on the print directory business, extracts revenue per capita that is nearly double that of its recently sold US counterpart, has an EBITDA margin that is 20% higher than YP Holdings, has EBITDA and revenue numbers that are declining at a much slower rate and is a fully intact corporation that cannot window dress their numbers, valuing it at a similar 1.74x multiple is grossly underestimating its true worth. I tried to quantify how much the window dressing effect and slower revenue decline could positively affect Yellow Media’s valuation. Combining these two effects would see the company be valued at 2.47x 2012 EBITDA.

However, what can’t be so easily quantified are the excess monopoly profits and the stronger performance of print directories in Canada. Using the $40/$22 ratio as a guide that would imply a 1.82 multiple of the 2.47x, resulting in a 4.5x 2012 EBITDA target valuation of $2,745M. Seeing as how that seems a bit too high, throwing a reasonable number of 3x 2012 EBITDA would value the company at $1,830M. This number seems about right when looking at the AT&T business as the two company’s EBITDAs will likely converge in two to three years based on current trends and $1,830M number is just slightly higher than YP Holding’s $1,792M effective valuation. Also, many Yellow Media bondholders speculated that the company could be worth between $1.4B and $2.2B – my $1.8B estimate is right in the middle of that range.

With Yellow Media valued at $1,830M, that leaves little question that the bondholders and banks will get the bulk, if not all, of their money back. After the recent decline in all of Yellow Media’s securities, the bond’s prices have been on a steady increase with the 2013 MTNs moving up to 60 cents on the dollar. I have little doubt that a buyer of the bonds at these prices will profit as they will continue to be bid up until they are at par or some kind of corporate transaction takes place where they are bought back for less than par but higher than where they are today.

The real interesting play becomes the equities. With a 3x multiple on 2012 EBITDA, there is about $300M in excess value left for shareholders. I won’t speculate as to exactly how that $300M would have to be divided up in order for common shareholders to approve a purchase of the company or a restructuring of the debt through CBCA, but I would expect both preferred shareholders and common shareholders to benefit greatly relative to current prices on those securities. The combined market capitalization of all common and preferred securities is about $55M, giving them about a 5x to 6x upside based on my valuation.

Yellow Media common shares trade on the TSX under the symbol YLO. The four preferred series trade under YLO.PR.A, YLO.PR.B, YLO.PR.C, and YLO.PR.D. The company’s debentures trade under the symbol YLO.DB.A.

Disclosure: I am long YLWPF.PK.

Please help improve Seeking Alpha:

Did you find this article useful?

-

Print

These assets are likely worth more if held for cash flow rather than sold off. Even with the current rate of decline, Cerberus will probably make 20% annual returns from this purchase. Yellow Media will not be forced to sell its print division as long as it can continue to retire its debt as it comes due, so at least two years from now.

Online revenues account for 30% of YM’s sales and growing. Yellowpages.ca and Redflagdeals.com are top 100 websites based on traffic in Canada. YM recently sold two online properties with lower rankings for 10x EBITDA. Management is guiding for a return to overall growth in 2014 driven by online revenues.

Once bank debt is retired or covenants are renegotiated, YM will be able to repurchase bonds, likely at a discount to par. This will reduce the debt load faster and free up cash that would otherwise go to interest payments.

I agree with you that the equity is likely worth considerably more than current prices.

http://bit.ly/J4AW58

http://bit.ly/J4AVhF

http://bit.ly/Ip7wek

In addition now that Canpages is gone, YLO is now the de facto encumbent print directory whale in Canada.

http://bit.ly/HSmixd#

http://bit.ly/HTFhTh

1) If/when the A&B are converted, a dividend for arrears will be paid on the C&D.

2) A&B, since they can be converted to common, are lower in the capital structure than the C&D — So in any kind of restructuring the C&D would get much better terms.

3) If A&B are converted to common, the B would get an entry at around $0.0384. There would be around 750M common shares outstanding after conversion (ballpark number to make it easier, i’m pretty sure it would be higher than that off memory). With bank debt, senior debt, debentures, pension obligations, C&D preferred… How much value is left for common in your analysis? 300M? 500M? 750M? Lets be generous and assume 750M, or $1 per share. From the 0.0384 entry point, that means a 26.04x bagger.

C&D preferred are worth $25 if there is 750M value to the common. You can buy them now for 70 cents. 25 / .70 = 35.7x bagger.

On top of that you get a 200% yearly dividend accumulation from current prices while you wait for the situation to resolve itself with the C&D series. So every year adds a 2 bagger to that total.

So you have greater protection in many scenarios from being higher up in the capital structure, have dividends accumulating quickly and have higher upside with the C&D series.

The B series, converted to common, would only reach the same upside as the C&D if the common fair-value price exceeds $1.37088 or the equivalent of 1028M value for the common (based on that 750M share number which is rough).

Just what enterprize value and EV/EBITDA would you need to assign to YLO for the common to be fairly valued at 1.028 Billion? Too high a bar from my mindset…

So yea, thats why I own the C&D (and bonds).

-Fernando

Oh and are we basing the valuation on the actions of Cerberus, the brilliant investor that bought Chrysler at the worst point in time imaginable?

Several years ago, a broker tried to convince me to buy Yellow Media in Canada when it was about $12 or so instead of purchasing Interpipeline (IPL) when it was about $9 and change. I stuck to my plan and bought Interpipeline instead.

Since then, I have collected oodles of dividends and IPL has more than doubled while Yellow has dropped into the cents range.

To me, buying Yellow is like eating putrid sardines from a previously opened can!

I could argue if they were wrong to recommend to buy the equity at $12, they were wrong to recommend to sell the equity sub-10 cents.

Regarding Cerberus, this is the latest data point we have to value the company. Like them or not, Cerberus is in business for good reason. Since 2008, many of the weakest links in the investment industry have gone under. If Cerberus is still around, they can’t be THAT bad as you assume. In fact, I’d say the opposite. If they learned enough from the Chrysler deal to still be around, the Yellow Pages deal is very likely to be a good one on their end.

http://bit.ly/I3UqDK

Czosnek, you said you owned the MTN due in 2013. Would you agree to shareholders getting a portion of the restructured company now while debt holders receive most of the new equity in the company (say around 90%) or would you prefer to wait it out?