First Off:

Why would you listen to me? I’ve done it before. Note that when I wrote that article I had titled it: “There is no risk with Conseco” but SeekingAlpha retitled it. What makes this a great opportunity is that no one will publish my thoughts on this company. Also note that I spent the last 2 hours arguing with my parents over why this company is worth owning and they think I’m insane for suggesting that this is a great value. No one wants to look at this company from the long side. PERFECT!

Set the stage:

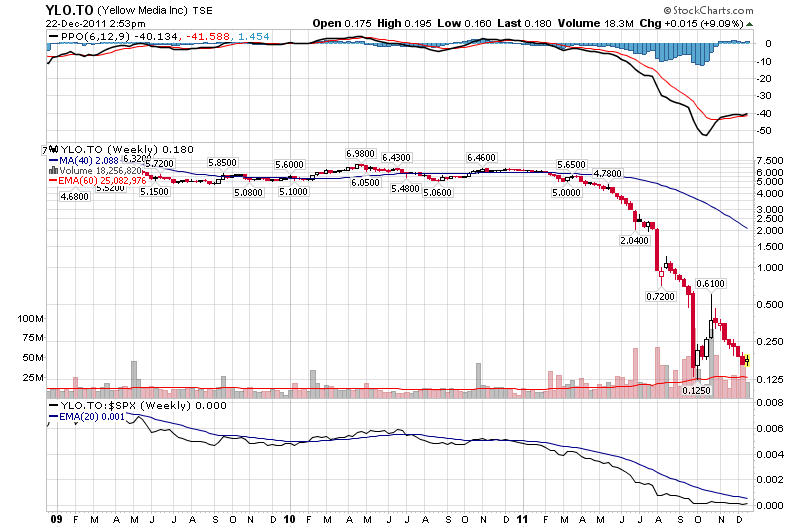

I have taken a siesta since earlier this year when I turned an about face regarding Chinese equities listed on US Exchanges. I used to think that they were real. Boy, was that an awakening experience. Apparently investing in the fundamentals as they are stated in SEC filings is not fundamental investing. Fundamental investing is investing in what those fundamentals are supposed to represent, the future and present profitability combined with the present financial position of a company. I recently restarted my e-mail newsletter and a good friend of mine says that I should take a look at this company traded in Canada. Historically, I’ve never spent much time at all looking at Canadian companies. After looking at this one, however, I am baffled by the present price. Well, that’s a lie. I’m not baffled. There are reasons that the company is cheap. But all of them combined do not warrant the present price being a sustainable price. My forecast is that higher prices are indeed in this company’s future. The chart below explains their past.

I looked at the website and clicked the chart and then ignored it:

I feel like this is the theme song coming from anyone who I recommend this company to. Everyone hates phone books. Everyone hates falling prices. That is, everyone but me, apparently. The short list of reasons why everyone hates this company:

- They cut their dividend.

- They were removed from an index.

- They are below $1.

- They are traded outside the USA.

- They are in a dying industry

- They might have credit problems.

- Their revenues are declining.

- They just lost a lot of money this last quarter, probably going bankrupt.

- The company has stopped giving guidance.

Even the analysts have given up:

I went out of my way to call the analysts. Optimistic? Not in the slightest. I had to practically beg them to give me information. They sounded completely dreadful. It was hilarious. Then, they admitted that they’d probably be fine at least through next year. Great success. Here are their reports: report 1, report 2.

Their last quarter’s results are on tap here.

All things aside, here are the reasons that I am buying:

- The company is hugely cash flow positive, especially on a price basis.

- This could be a 10-bagger from here fairly easily.

- The old owners wanted a dividend. When the dividend was cut, I expect all the grandmas sold.

- Tax loss selling ends soon.

- Sometimes people are forced to sell at low prices.

- The analysts have given up.

- The analysts projections are really really good! The price they justify is clearly not paying attention to their fundamentals!

- I’ve never seen a company go under that is making money and can pay their debts as they come up.

ProTip:

If you own YLO, take a look at their preferreds. There’s arbitrage opportunity if you short their common and go long their preferred A shares.

Disclosure: I am long YLWPF.PK.

Additional disclosure: I also own their series A preferred shares. I own both common and preferreds on behalf of myself and my investors.