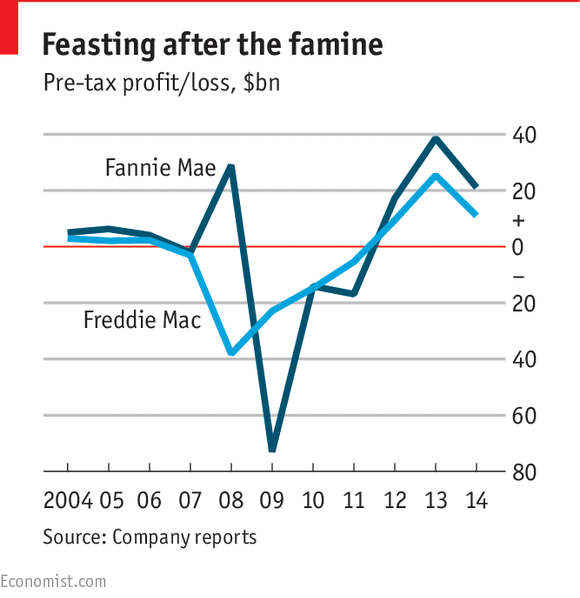

America’s mortgage-insurance giants are making bigger profits than before the crisis

FANNIE Mae and Freddie Mac may sound like a couple living in suburban America but they are in fact two of the country’s more unusual listed companies. With a government-backed guarantee, Fannie and its sibling Freddie buys mortgages from lenders and packages them for resale.

Looking at the headlines, it may seem that both Fannie and Freddie are in financial trouble again. On February 19th, Freddie Mac reported a sharp decline in its net income last year, which fell from $48.7 billion to $7.7 billion. The next day, on February 20th, Fannie Mae also announced a big fall in earnings. Falling market interest rates forced the pair to declare losses from their derivatives on their accounts, although the impact of this will even out in the long term.

But in fact both Fannie and Freddie have emerged from the financial crisis churning out more profits before tax than they have ever have before—despite their collapse along the way (see chart). Who benefits most from this is a subject of controversy. The government, having bailed out Fannie and Freddie in 2008, owns most of the pair. Other shareholders own 20%, but Barack Obama’s administration in effect expropriated these stakes in 2012: virtually all earnings now go to the Treasury. Two challenges to this arrangement are before federal courts. Critics contend that the government is sowing the seeds of another crisis by encouraging both firms to loosen their lending standards for political reasons. But in the meantime the American government can look forward to some healthy dividends from the pair.